Published on 7 December 2018

The Bank of England recently woke up and issued its Financial Stability Report and Stress Test results – November 2018. In it the Bank warned that a “further deterioration in Italy’s financial outlook could result in material spillovers to the euro area and the UK” [1].

In its more detailed comments the Bank noted that Italian Non-performing loans (NPLs) account for a quarter of all euro-area NPLs, and that, “although direct UK banking exposures to Italy are low, if financial strains were to spread across the euro area, there could be a material risk to UK financial stability. UK-owned banks have much higher claims on countries with close links to Italy, including France (63% of CET1) and Germany (74%)”[2].

As if on cue, Unicredit issued a US$3 billion bond which would fall outside protection from any bank deposit insurance scheme and be bailed-in (i.e. converted to capital-like instruments) should the bank be put into resolution [3].

The bond was purchased in its entirety by one investor – PIMCO. Most pertinently, the coupon on the bond was a fixed at 4.2% over the “swap curve”, this phrase meaning the fixed rate of interest at which an institution could enter into an interest rate swap between a fixed and floating rate for the same tenor as the bond: 5 years. The “swap curve” can then be read as meaning the interbank rate…although Unicredit is a bank, isn’t it, and should be able borrow at that rate and not 4.2% more??

As of now, the 5-year swap is at 2.978% so Unicredit would have had to pay 7.178% p.a. for its money, if the rate on the bond had been fixed at this moment.[4] This compares to a yield now on US government bonds of 2.85%[5].

Unicredit has been part of the recent European Banking Authority stress tests and has passed with a reasonably clean bill of health, as banking supervisors continue to accept Unicredit’s assertions – made in its H1 2018 Results presentation – about progress against its “Transform 2019” programme.

We recently researched Unicredit’s presentation for H1 2018, its 2017 Annual Report, and public information about the Fino NPL securitisation project, and came to a picture that is far less reassuring.

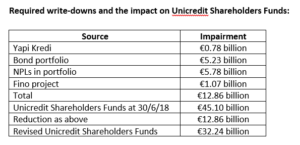

In our view Unicredit’s CET1 capital of €45.1 billion should be subjected to write-downs of nearly €13 billion, mainly because of over-valuation of Non-Performing Loans (“NPLs”), both the ones still in their own portfolio and the ones that Unicredit claimed were spun off in the Fino project but on which the bank still carries a major risk of loss.

The sources of the new write-downs of nearly €13 billion against Unicredit’s capital are:

- Yapi Kredi Bankasi – a 40.9% stake that should be reduced in value by €0.78 billion due to the fall in the Turkish lira;

- Unicredit’s bond portfolio which is concentrated on fixed-interest bonds issued by Italian public sector names which have risen in yield by 2% at an average 7-year maturity, causing a 14% loss on a holding of €37.35 billion, or €5.23 billion;

- Overvaluation by €5.78 billion against market/logical benchmarks of Non-Performing Loans retained after the Porto and Fino projects, where the categories “Bad Exposures” are over-valued by 13.2% of €24.1 billion, or by €3.18 billion, and “Unlikely to Pay” are over-valued by 14.86% of €17.5 billion, or by €2.60 billion;

- The Fino project should be put back on Unicredit’s balance sheet because it continues to bear a major risk of loss on the portfolio, and the re-consolidated assets of €2.14 billion are over-valued given available evidence by €1.07 billion.

This all adds up to a write-down of €12.86 billion.

As Unicredit’s Shareholders funds were €45.10 billion at the start of the year, the write-down reduces this to €32.24 billion, absent any operating profit or loss for 2018.

This is by far the end of the problem.

It leaves the bank stating its “risk-weighted assets” at €361 billion, when its latest balance sheet shows its non-risk-weighted, “on-balance-sheet” assets as €836.79 billion.

Its “non-risk-weighted assets” can be derived from dividing its claimed capital of €45.1 billion by its Leverage Ratio (given as 5.20% at the end of Q2 2018): this delivers a figure for non-risk-weighted assets of €867.31 billion.

The bank’s H1 2018 Results presentation does not state whether this figure of €867.31 billion is the equivalent of €836.79 billion figure as at 31/12/17, or whether there is an amount in there for Unicredit’s “off-balance-sheet” business.

Unicredit’s risk-weighted assets (“RWAs”) can be read either:

- as a 58.41% discount of the face value of its “on-balance-sheet” assets, with no RWAs associated with any “off-balance-sheet” business; or

- as an even bigger discount on its “on-balance-sheet” assets, with an undisclosed amount supporting “off-balance-sheet” business.

A 58.41% discount is very high for a bank that has generated such a large amount of NPLs in the past. It rests for its credibility on the quality of the Performing Loans, and on a supposition that they are of high quality, but we have seen in other Eurozone banking markets what measures – under the headings of “Forbearance” and “Restructuring” – have been employed both to ensure that loans do not fall into the NPL category and to back out loans already in it. In Cyprus, for instance, banks’ figures for their Performing Loans have been inflated with loans showing vital signs of non-performance e.g. the borrower does not meet their payments.

Given the above, the known problems of low growth in the Italian economy, and the recent ratings downgrade by Moody’s of the Republic of Italy, it is our view that a 30% discount would be more appropriate than 58.41%, with a further cushion required for “off-balance-sheet” business of €100 billion. This pushes Unicredit’s RWAs up to €707 billion, against which Unicredit should hold 9.5% CET1 capital, or €67 billion.

On that basis Unicredit comes out as what it is and what common sense tells us is the situation of a major bank in a country that is over-indebted and with weak economic growth: the bank is badly under-capitalised, with NPLs at the same levels as before “Transform 2019”. The only differences between then and now are firstly that the Fino portfolio of bad loans has been spun off into a structure that Unicredit is funding and which should be put back on its balance sheet, and secondly that the shareholders have paid in €13 billion in early 2017 to fund various write-downs that were taken in late 2016 amounting to €13 billion.

The shareholders now need to be asked for €35 billion more. This would firstly fund the new write-downs of nearly €13 billion and enable capital to remain at €45 billion. The remaining €22 billion would bring the bank’s CET1 capital up from €45 billion to the €67 billion where it would equate to 9.5% of its RWAs, Unicredit’s hurdle as a Level 1 Global Systemically Important Bank.

You can download the full research piece here

[1] Executive Summary (iii) p7

[2] Global debt vulnerabilities p50

[3] https://money.usnews.com/investing/news/articles/2018-11-28/pimco-buys-all-of-3-billion-unicredit-bond-source