Published on 6 January 2019

Financial markets have been seeing increased volatility lately, and one does not have to look as far as Bitcoin to see it:

- Seasoned corporate bonds have suffered an extended rout;

- Financial regulators have raised concerns about “zombie” companies – those that can just afford their debt service at very low rates of interest, but who will default as interest rates rise, which they are doing;

- Concerns about the health of the Italian banking system in view of the stand-off between Brussels and Rome over Italy’s budget;

- The contagion risk spreading to Greece and Cyprus, not helped by Moody’s assessment about Cyprus issued in the second week of November: “Among highly indebted European sovereigns, Cyprus (Ba2 stable) is most exposed to credit risks related to high household debt because it has a small economy, weak banking sector, and very elevated public and private debt levels”;

- Gyrations in the prices of oil and natural gas, the reason why the investment firm OptionSellers.com recently went under: the price of natural gas shot up nearly 20% in a single afternoon – to its highest price since 2014 – and then experienced its biggest one-day fall for 18 years.

This would indicate the need for greater caution in the process of setting KPIs for Liquidity Management.

The process begins with a policy, to be applied to the company’s Liabilities over the Liquidity Management time horizon (normally 90 days). The policy would require a process to identify all Assets and Liabilities with maturity dates below 90 days, and to allocate each one into a “time bucket”, accordingly to either the item’s contractual value date, or a reasonable expectation of when it will convert to cash.

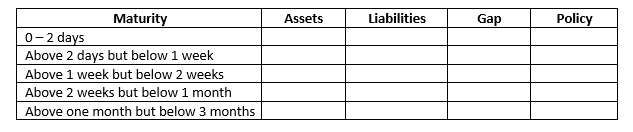

A typical grid of “time buckets” would look like this:

Then the policy addresses what Financial Assets need to exist against Liabilities (or Payables), so as to ensure that the Liabilities can be met on due date, even if the trading Assets come in late.

This element of the policy would apply a weighting to the Assets to account for the possibility of their coming in late, and that weighting might well be 0% for the first “time bucket” of 0-2 days: in other words the policy would require the company to hold Financial Assets in an amount of 100% of the Liabilities in that “time bucket”. All Liabilities could then be met on time, even if none of the trading Assets converted into cash on schedule.

Future “time buckets” might weight assets at 20%, 40%, 60% and then 100%, before entering them into the grid column headed “Assets”. The Gap is then that Asset figure minus the figure for Liabilities next to it. The Policy in the final column would state what level and type of Financial Assets need to be held against the Gap, and in what proportion.

In the current environment there is every reason to review the weightings of Assets with a conservative leaning, and then to go on to examining the definitions of Financial Assets to be held against any Gap in each “time bucket”.

A more conservative approach than now could entail one or more of the following:

- Increasing the proportion of the Gap to be held as Financial Assets, and there is no reason why the figure cannot be above 100% – because there is no absolute guarantee that any financial asset can be converted to cash without some form of loss of value and/or immediately;

- Changing the credit rating criteria for Financial Assets, especially for the ones held against Gaps in the earlier “time buckets”, as these ones might need to be converted to cash at very short notice: the better the credit rating, the lower the likelihood that the asset will prove itself to be illiquid on the day you want to convert it to cash;

- Altering the types of account in which money is held, from “Deposit” to “Notice”, from “Notice” to “Current”;

- Reducing the final maturity of investments, e.g. from 3 months to 1 month;

- Investing in a bank credit risk in a different way, e.g. buying a 1-month Certificate of Deposit (which is negotiable) as opposed to investing in a 1-month Fixed-term Deposit with the same bank.

What with trade wars, Brexit, tapering off of central bank Quantitative Easing programmes, and commodity price volatility, we seem to be looking at a period when financial markets will see unusual swings, and this is just such a period when it makes sense to review the assumptions and policies underpinning KPIs for Liquidity Management.

(First published by AccountingCPD.net)