– First published by IREF Online –

Published on 27th November 2023

Introduction

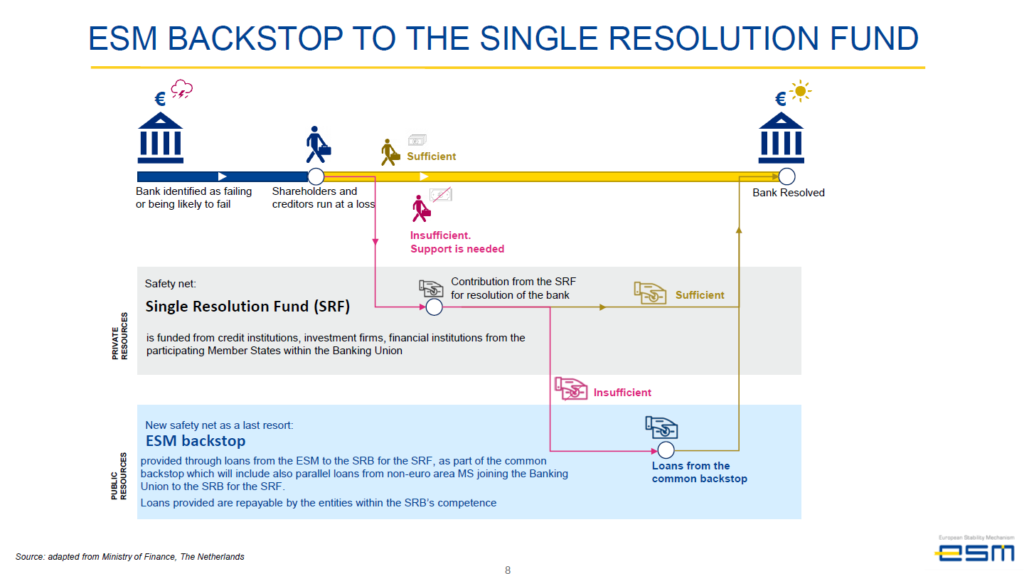

The European Stability Mechanism (ESM) will now be backstop-of-last-resort to the Eurozone banking system, in addition to backstopping the Eurozone member states and the currency itself. Its resources have not been increased, though, despite its credibility and firepower already hanging by a thread, the thread being France’s AA public credit rating.[1] The extra task is to backstop the Single Resolution Fund (SRF), which is the initial backstop for the Eurozone banking system. It sounds like the game of ‘pass the parcel’ and, like that game, no-one seems to know what it contains.

What is the nature of the new risk that the ESM is taking on?

The SRF exists to deal with a complex and important risk connected with Bank Resolution.[2] It was explored more fully in my book published by The Bruges Group in March this year.[3] The ESM’s being wheeled out to backstop the SRF is a clear signal that the European authorities recognise that the risk exists, and we can refer to the above chart in the ESM’s own Investor Presentation of July 2023.

The Bank Resolution procedure kicks in when a bank is identified as failing or likely to fail. Qualifying depositors in the bank with up to €100,000 are compensated out of the national Bank Deposit Insurance Scheme, with that scheme becoming the sole creditor of the new bank that should emerge out of the old one’s resolution.

Holders of any form of capital instrument in the old bank have their investment cancelled.

That leaves two classes of creditor of the old bank:

- Qualifying depositors with over €100,000, for the amount above €100,000;

- Non-qualifying depositors.

Their claims would be ‘bailed-in’. This means that they are converted into ‘capital-like instruments’ in the new bank. In other words they become its owners, and the capital that they own must be adequate to meet the key regulatory ratios: Leverage Ratio, CET1 ratio, Tier 1 Capital Ratio, Total Capital Ratio.

How does the risk manifest itself and who is it a risk to?

The risk manifests itself when, during attempted resolution, the old bank turns out to have had such poor asset quality that the new bank fails to meet these ratios with the ‘capital-like instruments’ into which the claims of the two types of creditor are to be converted.

Indeed, the new bank may have no capital at all if the assets are worth less than the claim of the national Deposit Insurance Scheme on it. This would occur, for example, if the bank had a large book of bad loans – ones formally classed as Non-Performing and ones that had been bogusly kept out of that category via ‘forbearance’, ‘restructuring’, and securitization where the bank is still at risk on the same portfolio of loans.

A shortfall – absent the SRF and the ESM – would cause a permanent addition to member state debt, given that the national Deposit Insurance Scheme is funded with new debt issued by the member state that backs it. This is what the member states want to avoid.

What is the role of the SRF?

The role of the SRF is to insert the shortfall. It is funded by the financial industry of all Eurozone member states, but its resources are finite. It would be used to socialize the shortfall across the financial industry of all Eurozone member states, until its resources were exhausted.

What is the role of the ESM?

The role of the ESM is to insert any residual shortfall after the resources of the SRF have been exhausted, at the same time socializing it across all Eurozone member states.

Why is the insertion of the SRF and the ESM attractive for member states?

To reduce the risk that an individual member state might be left with a permanent addition to its own debt. Instead the member states have chosen (as usual) the route of making their creature the ESM do the borrowings for them, and making the shortfall the responsibility of all.

Notably, though, they have increased the role and risk of the ESM without increasing its resources: the Eurozone member states’ contingent liability to pay in subscribed-but-not-called capital has not been raised. They have allocated an increased risk against an unchanged contingent liability in the hope that the risk does not materialize.

Cherishing this hope is facilitated by the insertion of the SRF as the initial risk-taker, a buffer in between the risk and the ESM.

The member states in this case insert two pseudo-autonomous buffering legal entities between the problem and the need to put their own cash on the line to solve it. A promise and a signature are put down instead of hard cash.

Conclusion

The assigning of roles to the SRF and the ESM towards the underlying issue proves it exists and is acknowledged. That is a step forward. Now the European authorities need to go further and disclose how large the issue is and what is the chance of its materializing. This would be the same as disclosing the extent of Non-Performing Loans in the Eurozone banking system as well as Performing Loans that have been subject to ‘forbearance’ and ‘restructuring’, and bonds or loans that derive from the earlier securitization of the bank’s own Non-Performing Loans. Only at that point will one be able to judge whether the ESM’s limited firepower is adequate to meet that eventuality as well all the others that are its role to meet.

[1] https://en.irefeurope.org/publications/online-articles/article/the-european-stability-mechanism-hangs-by-a-thread-on-frances-credit-rating/ accessed on 7 September 2023

[2] https://en.irefeurope.org/publications/online-articles/article/bank-resolution-is-dead-authorities-dare-not-use-it-and-instead-risk-destroying-capital-markets/ accessed on 7 September 2023

[3] ‘The shadow liabilities of EU Member States, and the threat they pose to global financial stability’, Chapters 3.vi, 4.iv, 4.vi, 15 and 16