Published on 26 February 2022

As already published on Facts4EU and Brexit-Watch

It has been reported that Chancellor Scholz has rejected the proposal that Russia be cut off from the SWIFT system as a punishment for its invasion of Ukraine. The Guardian has disseminated misinformation that it would anyway do little damage.[1] Scholz may imagine there is some upside to his refusal but one hopes this does not include the misapprehension that the Eurosystem (the complex of systems and arrangements that handle transactions of all sizes in Euro) can act as some kind of on/off ramp between Russia and the Western financial system. He will SWIFTly be disabused of that: if Russian financial institutions are sanctioned by the USA and those institutions remain addressable within the Eurosystem, all American financial institutions will have to pull the plug on their participation in the Eurosystem, which principally means TARGET2. The Euro cannot survive that, and in that eventuality the EU would break up as well. Chancellor Scholz may consider he has pursued a path of less risk, but he has not.

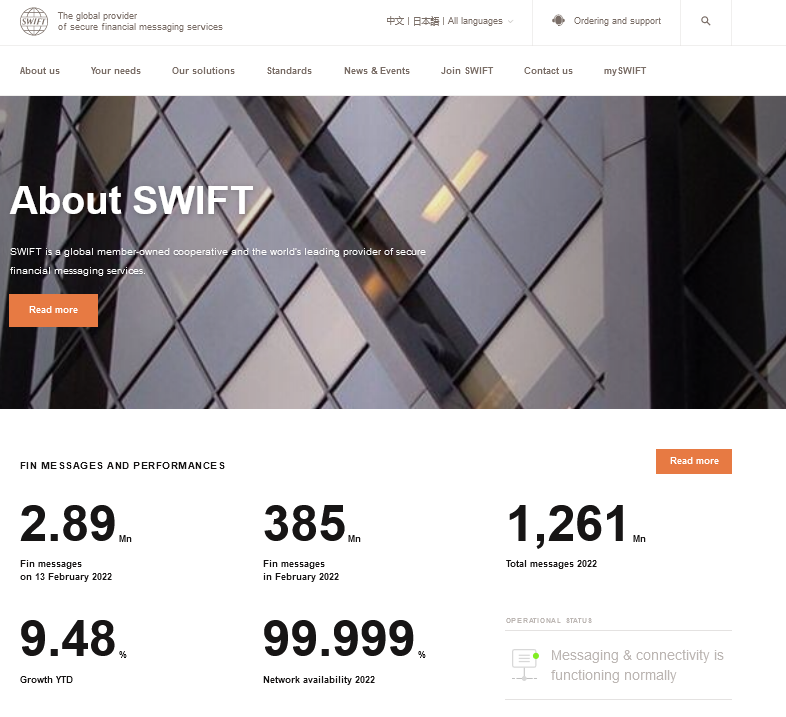

SWIFT is a vital financial messaging system principally carrying payment orders, asset movement orders, statements, advices and updates to members’ static data. It is integral to the efficient running of the Western financial system, and to the complexes of systems, processes and controls embedded in Western financial institutions and market infrastructures.

It is in particular integral to high-value payments, in that it is embedded into the world’s Real-Time Gross Settlement payment systems (RTGS), albeit at different levels. The US$ Fedwire RTGS has its own internal message format but this is fully compatible with SWIFT: foreign banks submit their Fedwire payment orders to their US correspondents over SWIFT and see them seamlessly processed through the Fedwire. The UK CHAPS system both uses SWIFT IT components and SWIFT messages, and CHAPS messages are transmitted over the SWIFT network. TARGET2 houses several variations, but all its messaging is SWIFT messaging, and a goodly portion is also transmitted over the SWIFT network.

SWIFT membership is therefore inseparable from RTGS access, which is in turn vital to operations of large value and to international payments:

- Settling any kind of transaction where the central bank is the counterparty

- Settling dealings in government securities

- Settling payments that have a contractual value date, such as for foreign exchange, loans, money market securities

- Making an immediate payment where the amount exceeds that possible under other channels e.g. a payment in UKpounds over £1 million cannot be done with a Faster Payment

- Making an international payment: banks will maintain other channels for doing them but SWIFT linked to RTGS is the final fallback

The Guardian interviewed an executive from VTB Bank, who said they could continue to move money via mobile and app and this is probably true – certainly within Russia, in rubels, and for modest amounts. If it was in Euro it is likely that the payment service being invoked would be SEPA INST service, for which the amount ceiling is €100,000.[2] Operations of size and in other currencies would be sorely inhibited.

It would be quite easy for SWIFT to cut off Russia: the network is in essence an email system where each SWIFT member has an address, called their Business Identifier Code, or BIC. The BIC consists of a core of 8 characters of which the fifth and sixth are the Country Code: RU in Russia’s case.[3] If SWIFT disconnected all such BICs, their owners could not send any messages into the network or receive any. If other members attempted to send messages to that BIC, they would be rejected at the sender’s SWIFT gateway application with the code NACK, meaning ‘Not Acknowledged’.

But it could not stop there. The BICs of dozens of other SWIFT members would need to be disconnected, such as:

- Subsidiaries and branches of Russian financial institutions outside Russia

- Russian corporates participating in SWIFT Corporate Access but from a processing centre in the UK, Ireland, Poland or wherever

A case in point would be VTB Bank (Europe) SE, Vienna branch.[4] Its webpage states that it acts as the correspondent for payments in Euro for over 100 other Russian banks, and that it relies heavily on SWIFT. Its BIC address will have the characters AT for Austria in the fifth and sixth position, and indeed it is DOBAATWW.[5]

This BIC address will be directly addressable in the TARGET2 system. TARGET2 is legally one single system, although it is logically decentralised: it is supervised by the European Central Bank (ECB) but access to it is granted by the Eurozone National Central Banks (NCBs), in VTB’s case the Austrian National Bank. The existence of sponsorship is invisible in day-to-day operation as all participants are directly addressable through their BICs, even though, behind the scenes, some commercial banks have their RTGS account on the TARGET2 Single Shared Platform and others have their RTGS account with their sponsoring NCB.[6] The ubiquitous usage of SWIFT messaging enables the intricacies of the architecture to be submerged.

What is important, though, is that all TARGET2 members are members of the same system. That means banks like State Street and Bank of New York Mellon in Luxembourg – who are major players in the safe custody of Euro securities – and JPMorgan, Citibank and Bank of America in Frankfurt – whose German operations act as the funnel for their group’s entire EUR payments business – are participants at the same level as VTB.

Financial institutions can also access TARGET2 indirectly, through a correspondent bank. If VTB were not a direct member but used Deutsche Bank Frankfurt as their correspondent, other banks could still address TARGET2 payments to DOBAATWW in the knowledge that routing tables within TARGET2 would relay the message to DEUTDEFF and Deutsche Bank Frankfurt would credit the payment to VTB’s account.

It is conceivable also that a technique has been found whereby all the 100 Russian banks that VTB claims to service are directly addressable In TARGET2, possibly by VTB issuing each one with an 11-character BIC based on its own 8-character stem. This might or might not be transparent to the other members of TARGET2.

If VTB is amongst the institutions sanctioned by the US government, US financial institutions will have to quit any financial market infrastructure of which VTB is a member. That means VTB (and others) either have to be kicked out of TARGET2 or the US institutions must leave.

This happened before with Bank Melli AG, the German subsidiary of the Iranian Bank Melli. Bank Melli AG had an account at the Bundesbank – obligatory as a German-incorporated bank. That meant it was a TARGET2 member and directly addressable. It had to be shut off.

The full list of sanctioned entities may take some days to draw up. The responsible US authority – FinCEN – has sufficient competence and experience to know that a VTB Bank (Europe) SE must be in scope or else a clear on/off ramp will be left open between Russia and the Western financial system.[7] That ramp would be closed if Russia was cut off SWIFT.

US financial institutions will cancel any RMA they have with VTB when VTB is sanctioned, RMA being the security process whereby one SWIFT member permits another to send it ‘value messages’.[8] Then they will be obliged to examine their continued membership of any financial market infrastructures of which sanctioned entities are members.

This process will be repeated in European institutions that have US banking licences in their group, like Societe Generale, BNP Paribas, Deutsche Bank and so on. They will not take the risk of having dealings with sanctioned entities even at two or three steps removed, for fear of losing their US banking licence, or of having FinCEN tag them as a bank that is supporting the circumvention of sanctions – which could cost the bank its ability to make and receive payments in US$.

Chancellor Scholz probably does not understand these mechanics in detail, and the fact that US sanctions will do 90% of what cutting Russia off from SWIFT would do, but much more messily. That mess could be catastrophic for the EU. Does Chancellor Scholz really believe that the Eurosystem is strong enough to withstand the loss of players like Goldman Sachs, Citibank, Bank of America Merrill Lynch and JPMorgan as market makers in Eurozone government securities, or of State Street and Bank of New York Mellon as custodians of Euro-denominated shares and bonds for global investors?

What happens when the major European banks are faced with the choice of quitting TARGET2 or being themselves sanctioned in the USA and possibly losing their banking access there?

The results of all of that could bring the Euro down, and if the Euro goes down, the EU probably goes down with it.

Simply cutting Russia off SWIFT would not only show solidarity with the Western alliance and be far less messy, it would protect Germany, the Eurozone and the EU from colossal risk. It is distressing to see politicians of Germany put their own country, its currency, many other countries – and so much else as well – in such dire peril.

[1] https://www.theguardian.com/technology/2022/feb/24/what-is-swift-international-payments-network-russia-sanction accessed on 25 February 2022

[2] https://thepaypers.com/payments-general/a-new-maximum-amount-for-the-sepa-instant-credit-transfer-stc-inst-scheme-is-live–1243272 accessed on 25 February 2022

[3] Many BICs are of 11 characters, but that is always a 3-character suffix after the stem BIC; a typical suffix is XXX, which means the head office of the bank. Banks may also have suffixes for a branch, or for an operations centre supporting a group of branches

[4] https://www.vtb.eu/en/financial/ accessed on 25 February 2022

[5] Originally Donau Bank AG, hence the first four characters of the BIC

[6] Single Shared Platform, run by the central banks of Germany, Italy and France, who rotate between their data centres the roles of production site, hot stand-by and warm stand-by. Although there is one version of the application at any one time, the version has to be deployed in identical form across sites in three countries and kept in synchronisation, so the Single Shared Platform cannot be described as a fully centralised system

[7] Financial Crimes Enforcement Network (FinCEN) is a bureau of the United States Department of the Treasury

[8] RMA = Relationship Management Application; ‘value messages’ are ones ordering payments, movement of securities and similar; a typical non-value message would be an announcement of an unscheduled bank holiday