Published on 11 June 2019 and previously by AccountingCPD.net

There have been many new entrants – usually non-banks – into the foreign exchange business whose value proposition is to reduce or eliminate the margin that traditional banks add to or deduct from the interbank rate in order to determine the rate quoted to the end-user client.

If the client is an enterprise rather than a consumer, it should have a KPI about measuring whether it is getting good rates for its business, when compared to interbank rates on the same day and for the same contract.

New entrants promising to eliminate the spread (or “margin” or “pips”) on the face of it offer a good way to fulfil or even exceed the KPI, though the habit of quoting the interbank rate as a single figure – as many claim to – is curious, if the result is to quote USD/GBP rate as 1.3059 or EUR/GBP as 1.1488.

Definitionally the interbank rate should be the rate that market-makers quote to one another in the standard market lot size in unstressed market conditions and in normal business hours. This rate will have a Bid rate and an Offer rate: the quoting institution proposes to buy at the lower Bid rate and sell at the higher Offer rate.

The difference between the two might be 10 “pips” – that is a difference of one in the third decimal place, making a price of 1.1515 – 1.1525. This would be quoted as “15 25” as market-makers would assume their fellows were well aware of what all the bigger figures were.

If the quoting institution states “1.1520 choice”, the other market-maker is at liberty to buy or to sell at 1.1520, but must do one or the other according to market etiquette. Market-makers are bound by this professional etiquette and in particular to make a two-way price to another market-maker without first enquiring in which direction their interest lies. That is the difference between a Professional Counterparty and a “professional counterparty”, the latter being party that conducts itself in a manner that is not amateurish but which is not compelled to make a two-way quotation when contacted.

Non-bank new entrants will not be Professional Counterparties, and may not themselves have immediate access to interbank rates: what they will do is to try and offset their purchases and sales, waiting until such time as they have an open position in the standard market lot size in a given currency pair, and then trade that away.

For a client of such a new entrant the first question is whether its prices are the mid-rate (or “choice” rate) or the more standard quotation with a Bid-Offer spread built in – but with no further reduction or addition.

If the standard market lot size in the currency pair concerned is US$5 million, then a client with an amount of exactly US$5 million to do should be able to get the interbank rate themselves. This is what a non-bank new entrant will be building up to, but if the client has such an amount to do to start with, there should be no benefit in going through the new entrant to get the best price. The issues in dealing with traditional banks become pronounced where:

- The amount is either broken, or less than the standard market lot size, or both; and/or

- The trade is for a broken date.

At the lowest end of amount, you have the “Tourist Rate” board, where the rates around an interbank mid-rate of 1.1520 could easily be 1.0815 – 1.2225. Traditional banks tend to find it easy to assign these very poor rates to:

- Foreign remittances for consumer clients;

- Small foreign commercial payments for business clients – which are normally done on a spot exchange rate and not covered by any hedging contracts using forwards or options

For an enterprise it should be quite straightforward to obtain the interbank rates for spot and forward transactions where the forward dates match the contracts the enterprise is entering into. These rates are frequently known the “on-the-run” data.

The above rates will act as the best guide from which to extrapolate a supposed interbank rate for broken dates and amounts, and for amending or unwinding an existing contract that was entered into bilaterally with a counterparty, a process known as “Over The Counter” or “OTC”, and which is the alternative to dealing in contracts across an exchange like the Chicago Board of Trade. “On-the-run” data serves like this:

- For a contract at spot, just the spot rate

- For a contract of one month, the spot rate and the 1 month forward points

- For a contract of 6 weeks, the spot rate, and the 1 month and 2 month forward points

- For unwinding a 12 month contract five months into its life, the spot rate, and the 6 month and 9 month forward points (or 12 month, if 9 month is not available)

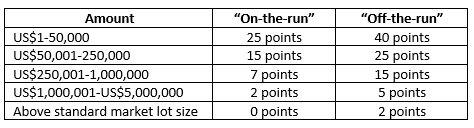

Either then the finance department or an application it is running would extrapolate the interbank rate, capture the rate at which the contract was dealt, and show the difference. This data would then be captured into a database on top of which a reporting application – holding the KPI’s set in the policy – would report the degree of achievement of the KPI’s. An example simple KPI would be the numbers of points away from the actual or extrapolated interbank rate at which contracts were to be dealt, like:

- “on-the-run” contracts: 5 points average

- “off-the-run” contracts: 15 points average

This should ideally be deepened into a grid by amount, for example into bandings of:

- US$1-50,000

- US$50,001-250,000

- US$250,001-1,000,000

- US$1,000,001-US$5,000,000

- Above standard market lot size

Then the tolerance for deviation from the interbank rate would fall as the amount became larger:

Application of the grid in practice should expose what the capabilities of the non-bank new entrants are:

- Do they offer the interbank rates at all?

- Just for spot, or for forward as well?

- Which forward periods?

- In which currencies?

If the non-bank new entrant really is offering interbank rates for all the currencies, periods and sizes that a Professional Counterparty would quote on, and extrapolating its prices for “off-the-run” contracts from the “on-the-run” prices, then the results against the above grid would be a complete elimination of the points.

If that is what they are doing, how are they making money if not by taking large open positions, or “punts”?

It is early days for these new entrants and we will see what limitations come to the fore in practice to their claim to be able to squeeze out the pips, or whether it is they who squeak.