Published on 26th October 2025

We have had a major report published by the Institute for Research in Economic and Fiscal Issues.

It is about the plans of the UK government to launch a decade-long programme of ‘investment’ in industry, infrastructure and Net Zero, greatly expanding the state’s role in the economy.

You can download the full report here.

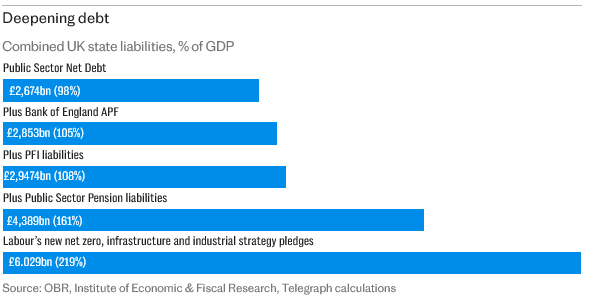

The programme is to be funded entirely with new debt of £1.64 trillion: the same amount as the spending programme. This is 58% of the UK’s 2024 GDP, on top of the UK’s existing Public sector net debt of around 100% of GDP.

Here is the graphic in the Sunday Telegraph today showing the effect of this new debt being added on top of Public sector net debt, and the other main ‘shadow debts’ of the UK:

The funding models for the programme ensure, however, that none of the debt will appear in the generally-accepted measures of a nation’s debt, like ‘Public sector net debt’ or ‘General government gross debt’.

The funding models for the programme nevertheless ensure that the burden of debt service will fall squarely on the shoulders of the same UK businesses and individuals who are responsible for ‘Public sector net debt’ and ‘General government gross debt’.

The debts will be ‘shadow debts’ of the UK, to service and repay which there will need to be a colossal imposition of ‘shadow taxation’. The programme will test the financial resources of UK businesses and individuals to breaking point, and possibly beyond. Hence the UK will act as a sandbox for an extreme and rapid implementation of these funding models, to fulfil public policy objectives.

The government plans to borrow around £270 billion of the total itself, as its contribution to the spend, and to make that borrowing disappear inside its new measure of the UK public debt, called ‘Public sector net liabilities’.

The remaining amount of £1.37 trillion is due to come from UK pension funds and miscellaneous international sources including China, and shadow banks.

The funding models are ones in common usage in the world of hedge funds, private equity, and shadow banking:

- A new version of Private Finance Initiative (PFI), originally invented in the UK, for schemes where a public sector entity is the user of the asset that is constructed;

- A ‘Direct sale’ scheme, based on the EU’s InvestEU model and frequently employed for clean power projects, whose product or service is billed directly to UK businesses and individuals as a quasi-tax.

Both types of scheme offer high returns to investors in them: consequently they are disastrously expensive for UK businesses and individuals.

Out of the £1.64 trillion investment amount, about £350 billion can be done through PFI at a lifetime cost of £512 billion.

The remaining £1.29 trillion can be done through the ‘Direct sale’ model at a lifetime cost of £6,151 billion.

The total financial imposition – at £6.7 trillion – comes out as 234% of the UK’s 2024 GDP.

At its peak, the debt service equates to an increase in taxation of 15% of GDP, from its current level of 35% of UK GDP to 50%.

The programme will test how many burdens can be placed on a Western capitalist economy before it collapses, and whether economic collapse takes the Western social and political model of a liberal representative democracy under the rule-of-law down with it.

It will test the limits of tolerance on the side of an electorate for the degree to which their representatives can act against their interests, both themselves, and in appointing further officials with delegated powers to act in their name but with indirect, if any, accountability.