Published on 25 October 2019

The UK was a major participant in the financial bailout of the Republic of Ireland in 2010-2014, and will remain so under the Withdrawal Agreement, notwithstanding its leaving the EU.

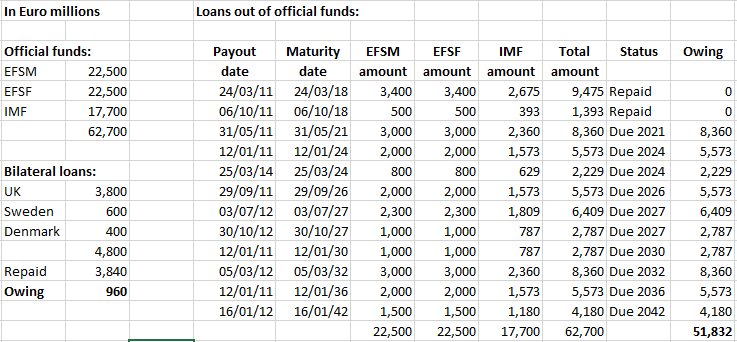

The bailout loans from the European Financial Stabilisation Mechanism (“EFSM”), the European Financial Stability Facility (“EFSF”) and the International Monetary Fund (“IMF”) totalled EUR62.7 billion, the final tranche of which was drawn in late March 2014, which – in true EU fashion – was actually three months after Ireland officially exited its bailout.

The UK is both a risk-sharing partner in the EFSM, and made a bilateral loan of EUR3.8 billion. This loan had been fully disbursed by September 2013, and its final instalment is due in March 2021[1]. Sweden and Denmark made bilateral loans totalling EUR1 billion and it is assumed that the Swedish and Danish bilateral loans had the same maturities and profiles as the UK one i.e. they are being paid off in 15 equal semi-annual instalments commencing in March 2014.

This means that, after the September 2019 instalment, there are just three instalments left on the bilateral loans. Three instalments of EUR253.5 million are left owing to the UK – EUR760 million – and three instalments of EUR66.6 million – EUR200 million in all – to Sweden and Denmark. The current outstanding balance on the three bilateral loans therefore totals EUR960 million.

As for the EFSM, EFSF and IMF money, each entity made an advance on the same day, in a constant proportion to their total commitment[2]: the proportions were EFSM and EFSF 22.5/62.7 each, and IMF 17.7/62.7, so when the EFSM advanced EUR1 billion on 30 October 2012, the EFSF advanced the same amount and the IMF advanced EUR786.7 million.

Two 7-year advances have been repaid: EUR1.4 billion disbursed on 6th October 2011 and EUR9.5 billion disbursed on 24th March 2011.

Ireland “exited bailout” in December 2013 and has had semi-annual post-programme surveillance reports published on it ever since[3].

This did not mean that Ireland had to repay its bailout monies, though. In true EU style a country can exit bailout without repaying the bailout monies. The loans from the EFSM, EFSF and IMF are still outstanding until latest 2042.

The current repayment profile and amounts still owing are as follows

The UK is exposed both through its bilateral loan and by dint of the EFSM being part of the Commitment Appropriation of the EU Budget.

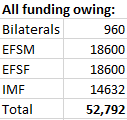

The UK Withdrawal Agreement contains a clause that makes the UK still open to claims that were part of the Commitment Appropriation as at the UK’s leaving date, so the current outstanding to Ireland out of the EFSM – EUR18.6 billion – could still come back onto the UK.

When one adds in the bilateral loan, the UK is exposed for EUR19.4 billion Again, despite exiting bailout, Ireland still owes EUR52.8 billion of its bailout money in total:

As we wrote in our recent Global Britain paper “The Irish economic miracle” with Ewen Stewart, Ireland’s Debt-to-GDP ratio has recovered to 64.6% in 2017 from a peak of 120% at the time of the bailout. However, when one eliminates the offshore, tax-related part of the Irish economy and measures Ireland’s debt against its Gross National Income – instead of against its claimed Gross Domestic Product – the ratio is a much less impressive 106%.

In addition, it is sometimes better to look at hard numbers. According to Eurostat, Ireland’s “General government gross debt” was EUR 47 billion at the end of 2007, EUR201 billion at the end of 2012 and EUR201 billion at the end of 2017.

[1] https://www.irishtimes.com/business/economy/ireland-pays-more-than-400m-in-interest-on-uk-bailout-loan-1.3053791

[2] https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/eu-financial-assistance/which-eu-countries-have-received-assistance/financial-assistance-ireland_en

[3] https://ec.europa.eu/economy_finance/publications/occasional_paper/2014/op195_en.htm