Published on 4 June 2018

We have today called upon Wolfsberg Group to make major changes to the section in the Wolfsberg Group’s Payment Transparency Standards 2017 on “On behalf of” payments.

The guidance is far from complete. In our view it has the effect of giving a clean bill of health to a range of services that are quite suspect given our understanding and analysis of applicable regulations on Anti-Money Laundering and Countering the Financing of Terrorism, or AML/CFT as they are known for short.

The guidance is far from complete. In our view it has the effect of giving a clean bill of health to a range of services that are quite suspect given our understanding and analysis of applicable regulations on Anti-Money Laundering and Countering the Financing of Terrorism, or AML/CFT as they are known for short.

All Wolfsberg Group’s 13 members figure in the Financial Stability Boards list of the world’s 30 Global Systemically Important Banks. Wolfsberg guidance has a meaningful impact on market practice, and on international banking services. What is more, Wolfsberg members include in their number some of the main proponents of these financial structures, so there has to be a suspicion of students marking up their own homework.

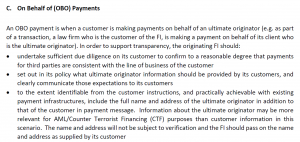

The section that exists in the Payment Transparency Standards 2017 only deals with payments i.e. with outgoing payments looked at from the point of the view of the remitting banks. Even that section needs to be expanded.

There needs to be a whole new section on receipts, looked at from the angle of the beneficiary bank. This side is not addressed at all.

We are also asking that Wolfsberg Group confirm explicitly that any financial institution that issues unique banking details associated in its own records with a specific legal person is an Account Servicing Institution for that legal person and must have a compliant Customer Due Diligence file on the legal person.

You can download our full paper here

Our analysis is based on a case study of a putative American bank as the organiser of such a scheme for a multinational client, using its London branch as the fulcrum and as the Account Servicing Institution for what it claims are the “real accounts” belonging to the client’s Shared Service Centre – as opposed to the Virtual Accounts, which each carry in their naming the identity of one of the client’s Operating Companies, and which are mainly established in the bank’s non-UK branches, subsidiaries and partner banks.

We have named this bank as “Security Home and Mortgage Trust Bank” or SHAM for short, with a putative BIC address of its London branch of SHAMGB2L.

There is a need for industry-wide clarity around the AML/CFT implications of both “On behalf of” payments and receipts, and of Virtual Accounts, the type of account to which “On behalf of” payments and receipts are normally posted.

Without the changes requested to the guidance on the contents of payment and receipt messages, there is a specific risk of non-compliance with implementations of FATF Recommendation 16 – such as EU Regulation 2015/847 of 20 May 2015 on information accompanying transfers of funds – because messages may not contain the details of both (i) the party that owns the real account that funds are debited or credited to; and (ii) the party that has entered into the contract for the supply of goods/services that the payment or receipt relates to, and “on whose behalf” the payment or receipt is being made or received.

Contrary to the inference of the Wolfsberg Payment Transparency Standards, though, it is not the details of Party (ii) – the “On behalf of” party – whose details are normally missing, but the details of Party (i) – the owner of the real account that is at the start or end of the payment chain.

There are two other major problems with the Wolfsberg standards:

- The standards infer that the real account sits in front of the virtual, or “On behalf of”, account towards the outside world, but in fact it is normally the virtual account that is presented to trading counterparties, and the real account that is invisible to them;

- These structures are principally used for receipts rather than for payments, such that the Wolfsberg standards are completely missing this side of it.

Virtual Accounts involve a bank issuing unique banking details to a specific legal person on the corporate side. In the bank’s books the banking details are linked to records in which the name of this specific legal person is visible. The bank is also aware that the specific legal person will use the banking details, and no others, in their dealings with third-parties.

These circumstances make the bank an Account Servicing Institution to that specific legal person, and compel it to carry out Customer Due Diligence on the specific legal person as laid down in applicable AML/CFT regulations. This seems to be an obvious truth, but it is not adhered to in “On behalf of” structures, and so it is vital that Wolfsberg Group explicitly confirm the obvious.